Earned wage access apps loans are transforming how workers get paid. Known more broadly as earned wage access (EWA) or on-demand pay, these services offer employees the ability to access wages they’ve already earned—without waiting for their official payday. Delivered via easy-to-use mobile platforms, they’ve become a popular alternative to payday loans and personal loans, especially for hourly or gig economy workers.

As more employers add earned wage access apps to their employee benefits packages, it’s essential to understand how these services work, what they cost, and whether they’re right for your financial goals.

Content

What are earned wage access apps?

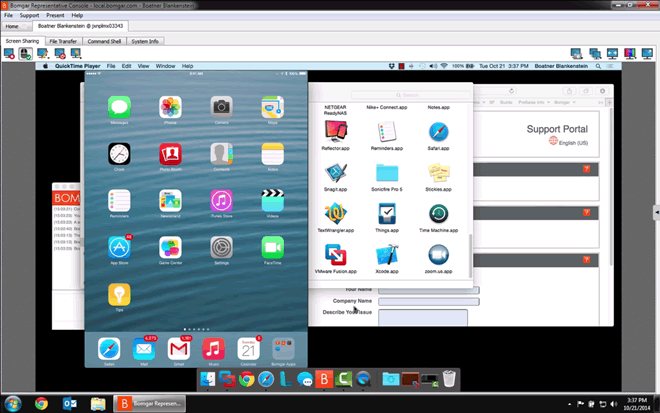

Earned wage access apps let workers withdraw a portion of their wages before payday. They do this by syncing with a company’s payroll system or with the employee’s time clock data. Users typically download an app, connect their employer or banking information, and can then view and access earned wages in real time.

Common features of these apps include:

- Same-day or instant cash transfers

- Flat fees or optional tipping models

- Spending insights and budgeting tools

- Integration with select employers or payroll providers

While these apps offer fast access to cash, they are often misunderstood as a type of personal loan. In reality, they’re not technically loans—since they give you money you’ve already earned.

How do earned wage access apps loans work?

The process is simple but varies slightly depending on the provider:

- Track hours or salary earned: The app monitors your work hours or calculates a pro-rated amount of your monthly salary.

- Request a payout: You choose how much of your earned wages to access—typically up to 50% per pay period.

- Receive funds: Money is transferred to your linked bank account, sometimes instantly, for a small fee.

- Automatic repayment: When payday arrives, the borrowed amount is deducted from your paycheck.

Though the word “loan” is sometimes used in marketing, EWA apps aren’t subject to traditional lending laws since they don’t charge interest or require credit checks. However, repeated use can mimic the financial strain of a payday loan if not carefully managed.

Pros and cons of earned wage access apps

Pros

- Quick and easy access: Funds can be accessed in hours—ideal for emergencies.

- No interest or credit check: Unlike personal loans, most EWA apps don’t require approval or charge interest.

- Improves financial flexibility: Can help cover shortfalls between paychecks or avoid overdraft fees.

Cons

- Fees can add up: Flat fees or optional tips may seem minor, but can be expensive with frequent use.

- Potential for dependency: Regular early access may result in a paycheck-to-paycheck cycle.

- Limited employer support: Some platforms only work with participating employers, reducing availability.

Top earned wage access apps to consider

If you’re exploring options, here are a few leading earned wage access apps to consider:

- EarnIn: Offers fast access with optional tipping and no fees.

- DailyPay: Partners with employers to provide instant transfers.

- Payactiv: Includes budgeting tools, bill pay, and financial wellness resources.

- Brigit: Offers advance cash, credit monitoring, and personalized insights.

Before choosing an app, review how it integrates with your employer and whether it fits your financial habits. Not all platforms are equal in terms of fees, usability, or access.

Alternatives to earned wage access apps loans

Though convenient, EWA apps aren’t your only option. Consider these alternatives:

- Personal loans: Useful for larger expenses, they offer structured repayment but may involve credit checks.

- Payday loans: Easy to get but typically carry extremely high interest and fees. Best avoided if possible.

- Credit cards or credit lines: Can provide short-term cash but may increase long-term debt if not paid off quickly.

- Credit union small-dollar loans: Often more affordable than traditional loans and come with consumer protections.

- Employer-sponsored financial wellness tools: Some companies offer zero-interest paycheck advances or savings programs.

Each alternative has trade-offs. Choose the one that matches your financial needs, urgency, and ability to repay.

When should you use earned wage access apps?

Earned wage access apps loans can be a smart tool in emergencies—like unexpected car repairs, medical bills, or avoiding overdraft charges. But if you find yourself relying on them regularly, it may signal that your monthly budget needs adjustment.

Some scenarios when EWA apps might make sense:

- You have a steady income and only need a short-term cash boost.

- You can cover upcoming expenses but want to avoid late fees or interest on bills.

- Your employer partners with a no-fee app and offers easy integration.

Scenarios to avoid using EWA apps:

- You consistently run out of money before payday.

- You are using multiple apps or stacking wage advances.

- You’re trying to manage long-term debt using short-term cash access.

Conclusion

Earned wage access apps loans offer a convenient way to take control of your finances between paychecks. For workers without emergency savings or with unpredictable expenses, they can serve as a helpful tool. However, they’re not a replacement for long-term financial planning.

If you choose to use an EWA app, do so with clear boundaries. Limit how often you use it, understand the fee structure, and look at how it fits into your broader money management strategy. For some, these apps provide helpful breathing room; for others, they can be a slippery slope toward financial stress.

Ultimately, earned wage access should empower—not trap—you. Use it as part of a balanced toolkit that may include personal loans, savings, and thoughtful budgeting.

Frequently Asked Questions

What is earned wage access?

Earned wage access (EWA) allows employees to access wages they’ve earned before their regular payday, often through mobile apps.

Are earned wage access apps considered loans?

Technically, no. EWA apps provide access to earned income without charging interest, so they aren’t classified as traditional loans.

Ryan Myers is a business blog author and writer. He graduated from the University of California, Berkeley in 2009 with a degree in Political Science. His favorite topics to write about are blogging for small businesses and becoming an entrepreneur.