An investment banker’s occupation entails “helping companies and governments and their agencies to raise money by issuing and selling securities in the primary market. They assist public and private corporations in raising funds in the capital market, as well as provide strategic advisory services for merger, acquisitions, and other types of financial transactions” (NPR 2012). With such a sophisticated and contemporary job description, investment bankers undoubtedly make up a bright bunch, with most major firms recruiting only from highly ranked, “target” universities and often times interviewing only the top 1% of each graduating class.

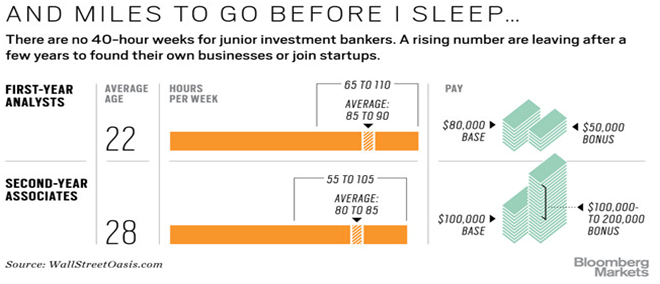

However, beyond the superficial prestige of being a banker lies the cruel reality of the physical, mental, and emotional tolls of the corporate working environment. According to Bloomberg Business, it’s not uncommon for a junior level analyst to be working an average of 90 hours per week for the first two years of his or her career (Bloomberg Business 2014). In addition to the sheer numbers of hours worked, the stigma of a stressful life “ordered by telephones, fax machines, and video monitors that instantaneously report the latest stock prices, corporate maneuverings, and political gossip” take a multi-faceted toll on the health and wellbeing of these bankers.

According to Dr. Alexandra Michel, a current professor of management at the Wharton School who started her career in 1992 as a junior banker at Goldman Sachs, “the long hours and stress begin taking their toll after only four years” (Bloomberg Business 2014). This parasitic culture of strained workers ultimately proves unethical, archaic, and to speak from the perspective of the firms themselves, illogical.

Thus, bulge bracket firms must make amends to their irrational internal work cultures to make way for sensible, efficient working environments; by doing so, firms will experience soaring increases in employee retention, employee satisfaction, and employee efficiency, ultimately promoting a positive company culture and a highly profitable business.

While This Working Culture is Recklessly Unethical, Its Illogical Nature is What Ultimately Harms Banks

The most pressing concern for a young graduate interested in a career in investment banking is often times the lingering doubt that either he or she may not be able to survive the intense work environment or that he or she will work hard to ultimately find the tolls of the job not worth the physical, mental, and emotional pains. In the case of Moritz Erhardt, a 21-year old intern at a Bank of America Investment Banking unit in London, the physical price he paid proved disastrous. Erhardt tragically died in the Merrill Lynch office after “working 72 hours straight,” an incident that directly caused large banks such as Credit Suisse to immediately place caps on junior analyst and intern working hours (Huffington Post 2013). Credit Suisse disclosed in an internal memo in January of 2014 that disallowed lower level analysts and associates from working on Saturdays (New York Times 2014). This proved to be a smart initiative by Credit Suisse, for upon the onset this new policy, several firms such as Bank of America and Goldman Sachs quickly followed suit (New York Times 2014).

By examining the figure below, one can expand even further on the unethical nature of this environment. According to Figure 1, we can see that a fresh college graduate is immediately launched into an average workweek of 85 to 90 hours. With the average full-time workweek of an American employee being 47 hours, this workweek is nearly double (Washington Post 2014). Furthermore, however, we can look at the second half of the figure to see that the starting salary of $130,000 over triple the amount of the average college graduate starting salary of $44,928 (Naceweb 2013).

Furthermore, this high salary serves as another testimony to the argument that this working culture is unethical. The strategy of these firms is simple: to lure in these bright and young graduates with a relatively high starting salary and once they take the bait, these new workers are being thrown into a harsh and fierce environment. Besides, they don’t call the working environment a “bullpen” for nothing.

Figure 1

(Wallstreetoasis 2011)

Moreover, even when we analyze the working conditions through a purely financial and quantitative lens as opposed to a moral one, it’s clear that these working practices are – in addition to being unethical – illogical and detrimental to the financial output of the firms. The simple fact of the matter is that these working conditions are unfit and it should be obvious that they are inefficient and impractical, and lead to lower productivity of individual employees and the firm overall. It’s clear to see that pushing fresh graduates to these physical, emotional, and mental extremes results in:

- Unhappy, unhealthy, and unstable employees

- Inefficient and unproductive employees due to unmotivated mental, physical, and emotional states

- High turnover rate due to employees leaving to seek a better lifestyle

- 44% of junior bankers leave within 3 years (efinancialcareers 2013)

- Stressful working environment doesn’t allow employees to blossom to their fullest potential

- Lack of company culture

- High turnover rate means employees come and go often, thus resulting in a lack of an obvious company culture

- Incorrect, uninspired motivation

- Analysts tend to undergo this experience simply for money as opposed to passion or innate desire to work

- Treat this as a boot camp, and employees will have the mindset when working of “can’t wait until this is over”

- Lack of opportunities for creativity

- 90+ hours of stressful work compromises creativity in return for productivity

- Overall negative company stigma, both internal and external

- Young graduates who may have initially been interested may be discouraged to pursue this career due to fear of the working schedule and fear of not being able to survive the period

- Internally, discouraged workers may cause internal team conflicts due to these negative working conditions

With these in mind, it should be clear that it’s investment banks should get rid of these drastic conditions and replace them with more effective, reasonable measures. However, those in favor of this tradition have their own points as well.

Arduous Work Structure Can Serve to Differentiate Employee Potential and Maintain Tradition

However, there exists another crowd that support this rigorous working schedule with seemingly good reason as well. Among some of these reasons include:

- “Boot camp” environment will differentiate serious analysts from potentially liable workers

- Allow for bright, intelligent graduates to temporarily explore a prestigious industry without committing too much of their early career life

- Maintain the long-time tradition of the banking industry

First, some may argue that this intense working environment along with its long hours can serve for higher-ups to see which employees are serious about the job. In addition, they claim it can serve as something along the lines of a boot camp or an extension to college, where graduates who are unsure of a career path can commit only two-years. This could also serve as a “weed-out process” for analysts to see whether or not they are cut out for a career in investment banking and if they are serious enough about it.

However, in response to this, it’s highly possible that this environment actually deters workers more than it does encourage them to come and explore. Similarly to other commitments like medical school, many aspiring students are actually discouraged given the social stigma and rigorous reputation that they never even attempt it. This is even more so the case in investment banking, as it is one of the most rigorous of them all.

Secondly, we may address the pressing issue that a change may incur too much inconsistency amongst the different firms and would disrupt the banking industry to powerfully that it would ultimately harm the industry. This holding of tradition and “how things have always been done” is an immature and undeveloped idea.

Ultimately, a change must be done. This is a pressing issue that if changes are made, impacts would be felt immediately. The lessening of hours will ultimately allow for an influx of more qualified candidates who are no longer afraid of the potential of getting burnt out early in their career and will keep employee retention up to record levels.

These changes are imperative in the banking industry. They will disrupt and innovate the way the industry operates and will ultimately make it a more reasonable and efficient industry. Ultimately, this is what the world needs from a financial powerhouse: an efficient workforce that is satisfied and highly qualified for their work.

Looking Past the Façade Reveals a Culture of Abuse that Must be Amended

It’s plain to see that this occupation, in addition to many similar financial service jobs, carries along with it the glitz and glamor of bustling financial districts around the world. This financial market and industry is a market that transcends political borders, a market controlled and scoured by these bankers. However, most people rarely peep through the glorious façade of being a “wolf of Wall Street” to see behind the scenes to the incredulous, and inhumane schedules of these workers. Should these changes be made, the banking industry can expect a complete makeover, resulting in an overall positive working lifestyle and more productive companies.

Works Cited

Alden, William. “Credit Suisse Tells Junior Bankers to Take Saturdays Off.” Deal Book Credit Suisse Tells Junior Bankers to Take Saturdays Off Comments. New York Times, 13 Jan. 2014. Web. 02 Apr. 2015.

Butcher, Sarah. “Nearly Half of Junior M&A Bankers at Top Banks Quit within Three Years.” EFinancialCareers RSS. EFinancialCareers, 19 Apr. 2013. Web. 02 Apr. 2015.

Garten, Jeffrey E. “WHEN THE DAY NEVER ENDS.” The New York Times. The New York Times, 28 Nov. 1987. Web. 02 Apr. 2015.

Kopecki, Dawn. “Young Bankers Fed Up With 90-Hour Weeks Move to Startups.” Bloomberg.com. Bloomberg, 08 May 2014. Web. 02 Apr. 2015.

Melendez, Eleazar David. “Moritz Erhardt, Investment Banking Intern, Dies In London.” The Huffington Post. TheHuffingtonPost.com, 19 Aug. 2013. Web. 02 Apr. 2015.

“Ask A Banker: What Do Investment Bankers Actually Do?” NPR. NPR, 09 Oct. 2012. Web. 02 Apr. 2015.

“Starting Salaries.” Starting Salaries. NACEweb, n.d. Web. 02 Apr. 2015.

Franklin is a business blog writer and author. He has had over 12 years of experience in the field, which includes working for companies like Microsoft, Philips Healthcare and Covidien. He loves to write about innovative technology that helps businesses thrive in today’s world of constant change.