In the bustling business landscape of the UAE, reliable accounting services are crucial for maintaining financial health and compliance. Whether you’re a startup, SME, or large corporation, finding the right accounting and bookkeeping services in Dubai is essential for your success. Let’s explore how to navigate the market and select the perfect fit for your business.

Content

1. Start with research:

Begin your quest for the best accounting services in Dubai by conducting thorough research. Utilize online platforms, directories, and referrals from fellow entrepreneurs to compile a list of potential service providers. Pay close attention to their reputation, experience, and range of services.

2. Evaluate Expertise and Experience:

Expertise matters in accounting and bookkeeping services in Dubai. Look for firms or professionals with extensive experience serving businesses like yours. They should be well-versed in local regulations, tax laws, and industry-specific nuances to provide tailored solutions to your financial needs.

3. Check the services offered:

Every business has unique accounting requirements, so ensure your services align with your needs. Choose a provider who can handle all aspects of your business’s financial operations, from basic bookkeeping to tax preparation and economic analysis, by offering a wide range of services.

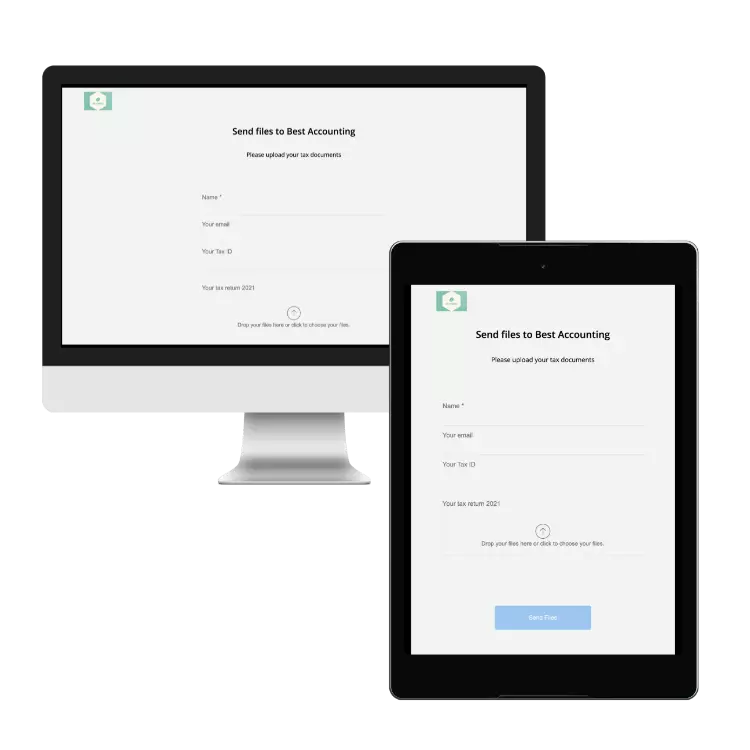

4. Assess technology integration:

In today’s digital age, efficient accounting relies heavily on technology. Seek firms that leverage cutting-edge accounting software and tools to streamline processes and enhance accuracy. Cloud-based platforms facilitate real-time collaboration and ensure the security and accessibility of your financial data.

5. Consider cost and affordability:

It is important to consider the pricing structure of accounting services in Dubai, even though it should not be the only consideration. Choose a service provider with clear, upfront pricing with no additional costs. Examine estimates from several companies and select the one that offers the most value for your money.

6. Prioritize Communication and Support:

An effective working relationship with an accounting service provider depends on effective communication. Ensure they promptly, courteously, and appropriately respond to your questions and issues. Your reviews should be given to a dedicated account manager or team for individualized attention and support.

7. Seek Client feedback and Reviews:

Consult with current and former clients of the accounting firms you are considering before makingnline testimonies, recommendations, and reviews can provide insightful information about the caliber of the service, dependability, and degree of customer happiness.

8. Verify credentials and accreditation:

Renowned regulatory organizations should recognize reliable accounting service providers in Dubai with the required authorizations and certifications. Check their qualifications to ensure they abide by the rules and legislation in your area pertaining to the accounting industry.

9. Emphasize Trust and Confidentiality:

Entrusting your financial data to a third party requires high trust and confidentiality. Choose a reputable accounting firm with a proven track record of maintaining discretion and safeguarding client information.

10. Plan for Long-Term Partnership:

Building a solid relationship with your accounting service provider is essential for long-term success. Look for a partner committed to understanding your business goals and evolving alongside your organization’s needs.

To sum up, locating the top accounting services in Dubai necessitates carefully weighing several variables, such as experience, services provided, technological integration, price, communication, and reliability. These guidelines and careful investigation will help you choose a trustworthy partner to handle your company’s financial management. Recall that in Dubai’s dynamic economic scene, investing in high-quality accounting services is an investment in your company’s future success.

Ryan Myers is a business blog author and writer. He graduated from the University of California, Berkeley in 2009 with a degree in Political Science. His favorite topics to write about are blogging for small businesses and becoming an entrepreneur.